Pay what you owe: Higher learning and student loan debt

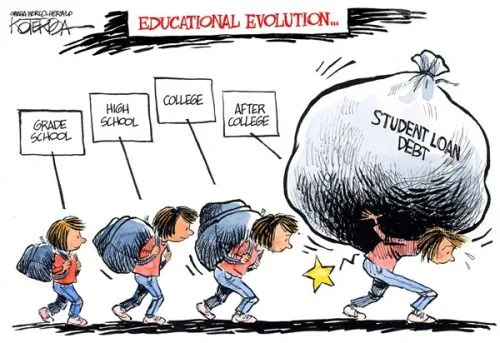

August 4, 2015 and December 18, 2015 are two of the most memorable dates up to the 33 years that have been spent on this earth. The first signified the successful defense of a dissertation while the second marked the official end of a journey that has taken place since 5 years old. It was the culmination of 28 years of formal education. The latter should have been a joyous occasion, and it was. However, it was also the realization that while one accomplishment was reached, another challenge awaited, a challenge and an obstacle that anyone who has pursued a higher education and used financial assistance in the form of student loans knows all about: paying student loans back.

For the next ten years, the mission, willingly accepted or not, is to pay back student loans and, honestly, it is a mission that is looked at not with complete dread and disgust, but with curiosity and, yes, anticipation. There is something to be said for people who pay what they owe. Paying what you owe is a sign that someone’s word is bond. Sure, it would be easy to join the chorus of students saddled with serious and substantial student loan debt and scream, “Fuck Sallie Mae,” but all the screams and chants in the world won’t change the balance that’s owed on those student loans. So instead of being pissed off about it, the goal is to embrace the challenge of paying what is owed.

As someone who plans to stay in higher education in the form of public schools for a while, there are a variety of ways to pay what is owed. One is to win the lottery and just pay it all back in one sum. However, that logic rests on the 1 in 292 million odds of actually winning the damn thing (1). With that said, chances are that there’s still a chance, so a ticket will be purchased weekly, because a person can’t win if a person doesn’t play.

Another way to pay what is owed is to pay them off as fast as possible, yet do so in a responsible effort while making reasonable and responsible sacrifices. This way can come off as vague, but what it really means is to do some homework and do some research, and while the words “homework” and “research” are associated with formal education, the same words are associated with lifelong learning anyway, so there is no need to run from them. Making responsible sacrifices may mean not going out to eat so much (2), and it may mean to get your hustle on in the form of a second job. If the words “second job” are kryptonite, because they certainly are on this end, refer to it as a hustle instead. Yeah, it’s mind manipulation, but if it works and allows for another way to get money, do what it takes and manipulate the mind.

Another way to do it is in the form of income-based repayments, or IBR. The plan allows borrowers to make payments based on their income (3), and while it means people are going to get in your personal business, it also means being able to have a decent quality of life while trying to improve earning actuality at the same damn time. The words “earning actuality” are more realistic than “earning potential.” Earning potential is bullshit, especially after finishing school and still not cashing in on that potential despite being in school forever and earning degrees, but that’s another story for another day. IBR allows folks to work on paying off debt while being able to live with some semblance of freedom and dignity, even if it takes a while. Folks under IBR have payments capped at 15 percent of their discretionary income and must make payments for up to 25 years to have the remaining balance forgiven (4).

Another program is the public service loan forgiveness, or the PSLP. For folks with student loan debt working in the nonprofit or public sector, they are eligible for loan forgiveness on federal loans after making 120 consecutive qualifying monthly payments on their student loans (5). The thought of making student loan payments for the next ten years may be absurd, but at least it isn’t as long as the length of the IBR plan. Besides, no one held a gun up and threatened to shoot when the option for “accept loan awards” for student loans came up as one of the qualifying awards on a FAFSA application. Simply put, reasonable options are available to pay back student loans and should be used, and this is coming from someone who owes a shitload of them.

Regardless of how one feels about Sallie Mae, and it’s easy for her to be Public Enemy #1 in the eyes of college students who owe student loans, the bottom line is when money is borrowed, it should be paid back. Whether it’s $10 to buy some lunch or $10,000 to pay for expenses associated with school, if a person is gainfully employed and draws a consistent salary and has student loan debt, then what is owed should be paid, and that is going to be the plan. When it’s all said and done, the date of the last student loan payment will go up there with the dissertation defense date and the graduation date as ones that will be remembered for life.